How Much Does Pet Insurance Cost? Deductibles, Premiums, Reimbursement, Fees, Claim Limits, And More – CanineJournal.com

To sustain this free service, we receive affiliate commissions via some of our links. This doesn’t affect rankings. Our review process.

Find out what factors go into determining the cost of pet insurance. Is the monthly premium worth it in the long run? How much should you pay for pet insurance? We explain how it works, breakdown the jargon, and cover all your questions in one article. It could save you thousands of dollars in vet bills and, more importantly, give you peace of mind when caring for your furry family member.

What Determines The Cost Of Pet Insurance?

There are four main elements that you’re responsible for paying in regards to a pet insurance policy. (We’ll explain how each of these impact the portion you’re responsible for paying in more detail below.)

- Deductible

- Copay

- Premium

- Extra Fees

Deductible Types: Annual vs Incident

The deductible is the portion of the vet bill you’re responsible for paying before reimbursement. The lower the deductible, the higher your monthly premium will be. The opposite is true as well; the higher the deductible, the lower your monthly premium is. There are two main types of deductibles, annual and incident.

Most companies let you choose your deductible. However, Nationwide is the exception here and has a set $250 deductible.

Remember that if your contract does not explicitly say that a procedure is covered, it is not likely to apply to your deductible either. These items can vary depending on the pet insurance plan, so we suggest reading your policy carefully. Pre-existing conditions do not apply to your deductible.

Annual Deductible

Pet insurance plans that utilize annual deductibles require you to meet your deductible once per policy term. So once you meet your deductible, your claim reimbursement only subtracts the copay until your policy’s renewal. When the policy renews, your annual deductible resets.

An annual deductible is easier to budget for because you know you’ll only have to meet the deductible once throughout the year (this isn’t the case for incident deductibles) if your pet experiences any accidents or illnesses. Annual deductibles are typically more preferred because it’s usually less costly to you.

The majority of pet insurance companies we review have annual deductibles.

Examples

The table below shows how the claims process would work for a pet with a $100 annual deductible who visits the vet three times in one policy year.

| Claim #1 | Claim #2 | Claim #3 | TOTAL | |

|---|---|---|---|---|

| Accident/Illness | Foreign Body Ingestion | Diarrhea | Vomiting | |

| Bill | $3,409 | $650.88 | $214.55 | $4,274.43 |

| Annual Deductible | -$100 | $0 | $0 | -$100 |

| 10% Copay | -$341 | -$65.09 | -$21.46 | -$427.55 |

| Reimbursement | $2,968 | $585.79 | $193.09 | $3,746.88 |

Instead of paying $4,274.43 in vet bills, this pet parent only had to pay $527.55 and was reimbursed $3,746.88.

Incident Deductible

A per-incident deductible means you have to meet the deductible multiple times for each new emergency your pet encounters. This type of policy typically reimburses you less if your pet sees a vet for multiple medical conditions in one policy term.

Per-incident deductibles can be more challenging to budget for because you don’t know how often your dog will need to be seen by the vet. And for each new condition a vet sees your dog, you should expect to pay an incident deductible.

Trupanion is the only pet insurance provider we review that has a per-incident deductible. However, once you’ve paid the deductible for a condition, it is covered over the pet’s lifetime as long as you have continuous coverage from Trupanion.

Examples

The table below shows how the claims process would work for a pet with a $500 annual deductible who visits the vet three times in one policy year.

| Claim #1 | Claim #2 | Claim #3 | TOTAL | |

|---|---|---|---|---|

| Accident/Illness | Foreign Body Ingestion | Diarrhea | Vomiting | |

| Bill | $3,409 | $650.88 | $214.55 | $4,274.43 |

| Annual Deductible | -$100 | -$100 | -$100 | $300 |

| 10% Copay | -$341 | -$65.09 | -$21.46 | $427.55 |

| Reimbursement | $2,968 | $485.79 | $93.09 | $3,546.88 |

Instead of paying $4,274.43 in vet bills, this pet parent only had to pay $727.55 and was reimbursed $3,546.88. As you can see, this pet parent had to pay more out of pocket than the example of the annual deductible above.

Reimbursement Percentage

The reimbursement percentage is the amount covered by the pet insurance company after your deductible. The remaining portion is your copay, which is the amount you must pay per incident after your deductible. For example, if you select 80% as your reimbursement, then your copay is 20%.

Most companies let you choose your reimbursement. However, some companies have set deductibles (like 24PetWatch with 80% and Trupanion with 90%).

Premiums

Get 4 Free Pet Insurance Quotes

Premiums (paid monthly, quarterly, or annually) are based on unique factors associated with your pet. These factors can vary based on the company you buy from, but these are the variables most insurance companies consider.

- Species: Dogs are typically more expensive than cats because they’re larger and require higher doses of medication, larger medical equipment, etc. Additionally, cat owners tend to submit fewer claims than dog owners.

- Gender: Male pets tend to have more claims than females. So females are considered “lower risk.”

- Age: Premiums increase as the pet ages because older pets are more likely to fall ill or become injured.

- Breed: Some breeds are predisposed to genetic conditions or are more likely to become injured, depending on their size. Larger breeds and breeds predisposed to illnesses are “higher risk,” which increases the premium.

- Location: Vet care is more expensive in larger metropolitan areas, so pet insurance companies charge a higher premium to help offset these expenses.

Extra Fees

Some pet insurance companies charge one-time enrollment fees, processing fees, or other maintenance fees. The table below shows the fees associated with each pet insurance company we review.

Take these fees into consideration before signing any contract because they could influence your purchase decision. Some companies will waive transaction fees if you pay for multiple months in advance.

Factors That Don’t Affect The Cost Of Pet Insurance

These items don’t impact your pet insurance premium.

- Number of claims submitted

- Pet’s weight

- Whether the pet lives indoors or outdoors

- How the pet was obtained (shelter, breeder, stray, etc.)

What Are Claim Limits?

The claim limit is the highest amount a pet insurance company will reimburse during the policy period or over the pet’s insured lifetime. A lower claim limit means you may be liable for more costs if your pet experiences expensive vet treatment.

All of the companies we review have annual claim limits except for Trupanion, which has a lifetime limit term. However, since its only claim limit option is unlimited, this isn’t too concerning.

The majority of the companies we review offer a few options for claim limits. However, Healthy Paws and Trupanion offer unlimited claim options. While unlimited claim options are great since you don’t have to worry about hitting your maximum, it can increase your monthly premium.

The table below shows the claim limit options from each company we review.

| Company | Review | Claim Limit Options | Limit Term |

|---|---|---|---|

| Read Review | $5,000, $10,000, $20,000 | Annual | |

| Read Review | $2,500, $5,000, $7,500, $10,000, $15,000, $20,000, Unlimited | Annual | |

| Read Review | $3,000, $5,000, $7,000, $10,000 | Annual | |

| Read Review | $5,000, $8,000, $10,000, $15,000, $30,000 (Unlimited available via phone) | Annual | |

| Read Review | $5,000, $10,000, $20,000, Unlimited | Annual | |

| Read Review | Unlimited | Annual | |

| Read Review | Limited Per Condition, Unlimited | Annual & Per Condition Annually | |

| Read Review | $1,000, $2,000, $5,000, $10,000, Unlimited | Annual | |

| Read Review | $2,500, $5,000, $10,000, $15,000, $20,000, $25,000, Unlimited | Annual | |

| Read Review | $5,000, Unlimited | Annual | |

| Read Review | Unlimited | Lifetime |

What’s A Benefit Schedule?

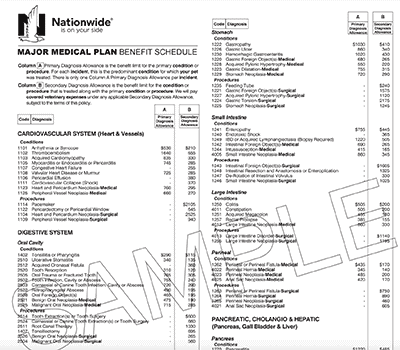

Nationwide is the only company we review that uses a benefit schedule for its reimbursement method. A benefit schedule includes a list of diagnoses and the maximum amount of money the pet insurance company will pay if a vet treats your pet for that condition or procedure. If the total bill(s) exceeds the benefit schedule’s listed sum, you’re responsible for it.

Benefit schedules can leave you paying a hefty portion of the vet bill and are typically less desirable. Here’s an example of a benefit schedule.

How Reimbursement Works, In 6 Steps

- Visit The Vet – Most pet insurance companies let you go to any licensed vet but verify this beforehand.

- Pay The Vet – You’re responsible for paying for all the vet bills at the time of service.

- Get An Itemized Invoice – Be sure to get an itemized invoice from your vet, as you will need to include it when you file your claim with the pet insurance company.

- Submit Your Claim – You may be able to submit claims in various ways, depending on the pet insurance company (e.g., app, email, mail, fax, etc.). Submit your claim form with the vet invoice and any other required paperwork.

- Wait For Approval – The pet insurance company will review your claim and notify you of their decision on whether or not the claim is eligible for reimbursement.

- Receive Payment – If approved, the company will reimburse you for the amount based on your policy by sending a check in the mail or via direct deposit. (Processing time can range from days to months, so if getting the money back in your pocket in a timely manner is critical for you, find out the average before you commit to a company.)

Some pet insurance companies offer to pay vets directly instead of requiring you to pay for the vet bill and then wait for reimbursement. If this is something of interest to you, you’ll want to consider this before choosing a pet insurance company.

Read Real Pet Insurance Stories

Read some examples of pet insurance quotes and reimbursement stories to see how pet insurance works in real life. You can also obtain a quote from our top-ranked pet insurance companies using our quote form.

If you have any outstanding questions regarding how much pet insurance costs or how to calculate any of the factors we mentioned above, be sure to ask us in the comments below.

Which pet insurance cost factor do you find most confusing?

Sources: [1] NAPHIA, [2] Lending Tree